open end lease meaning

An open-end lease has more flexible terms and the lessee takes on the depreciation risk of the asset. Open-end leases are a type of operating lease.

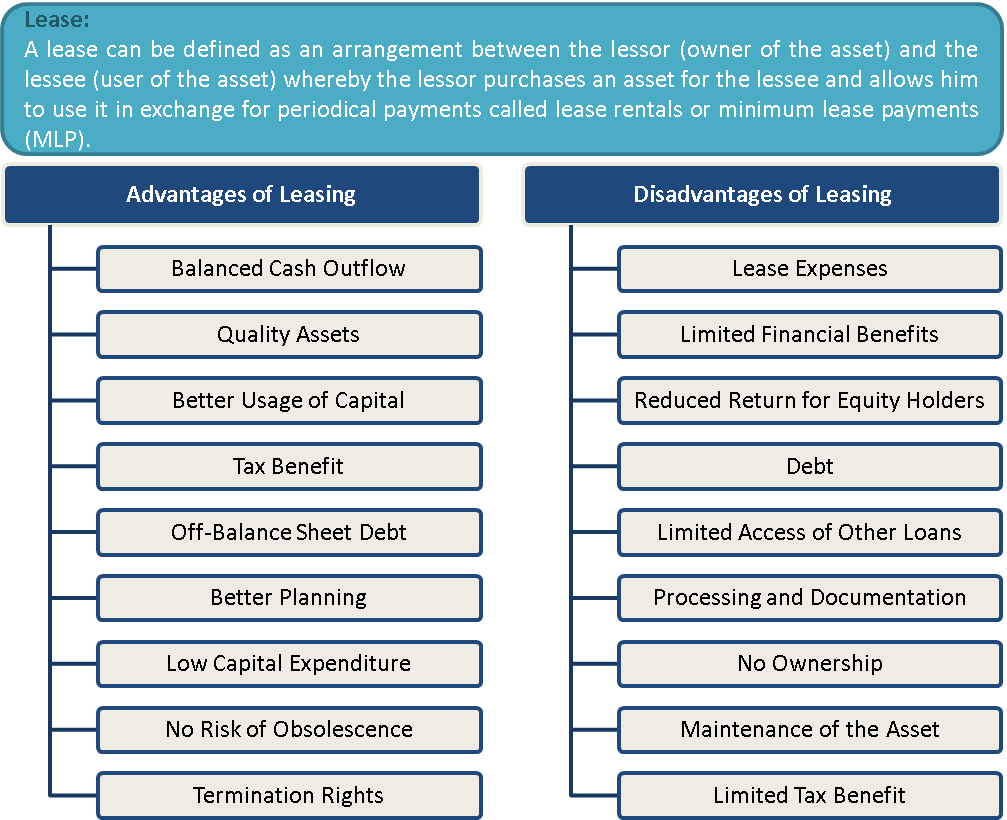

What Is Leasing Advantages And Disadvantages Efinancemanagement

Typically an open-end lease is cancelable by the lessee after a minimum period with the lessee.

. Many wonder what is an open end lease. If you rack up the miles on the leased car or cause some damage then you could be paying for it at the end of the lease term. In a closed-end lease at lease-end you are responsible for the condition of the vehicle that is any excessive wear and use.

An open-end lease with a TRAC allows a rental adjustment against the vehicles outstanding book value at the end of the lease. Unlike a closed-end lease where you pay per mile and. In a closed.

In an open-end lease you are responsible for the vehicles value that is any deficiency between the realized value and the residual value. Open End Lease Agreement drawn up during lease creating an obligation on the lessee to buy the property when lease expires. The employer takes all the financial risk.

Basically your equipment has a set value when it is first leased to you. Closed-end leases are not considered operating leases. Over time the value drops whether its because of how you take care of the hardware or just because it is older and outdated.

An open-end lease is a lease contract that provides a final additional payment on the return of the property to the lessor adjusted for any value change. If the realized value is greater than the residual value the lessee may receive the difference subject to prior agreement. Very simply in an open-end lease the lessee assumes the depreciation risk but has more flexible terms.

This works well for employers since the cost of the vehicles can be written-off or expensed. Open-End Lease is often referred to as a finance lease. In an open end lease a lessee stands to be obligated to cover the potential costs of product value depreciation.

Open-end leases allow the lessee the one who borrows the vehicle to guarantee a value at the end of the lease. According to Credit Karma an open-end lease has flexibility when it comes to mileage limits and lease terms. This payment scale is public when the lease terminates.

This type of lease means that you the lessee are responsible for the difference between the estimated residual value of the leased vehicle and its true market value when its time to turn the car in. Amount credited is frequently about 5 percent below the wholesale value of the vehicle. You can return the vehicle and either receive a credit or a bill for the difference between what you owe and how much the vehicle is sold for.

The lease contract usually a car or means of transport in which payable payments completely debt. Your rights and obligations at lease-end are different in an open-end lease and a closed-end lease. Open-end leases are generally blanket or master leases with multiple takedowns of equipment.

A lease providing for increases in rental payment at specified dates. What is Open-End Lease. Open-ended leases allow landlords and tenants to change the conditions of their lease agreements with a 30-day written notice unless otherwise specified.

They normally involve portable or mobile equipment that is clearly not special purpose to the lessee eg automobiles or other fleet-type vehicles. The risk in this case is really referring to the potential for commercial equipment items to depreciate in value over the course of a leasing term. Random Finance Terms for the Letter O Open Position Open Repo Open-End Fund Open End Lease Open-End Mortgage Open-Market Operation Open-Market Purchase Operation Open-Outcry Opening The Opening Bell Recommended for you.

The final payment will cover the difference between the initial price of the asset and the end evaluation of the asset. A lease that provides at expiration the opportunity for the lessee to purchase the car or to extend the lease term. The most common type of car lease also known as a closed-end lease.

This is called the Guaranteed Residual Value GRV and is outlined in the lease contract. There are typically two types of leases. Open-end leases also exist and are most often used in the case of commercial business lending.

A lease that may involve a balloon payment based on the value of the property when it is returned. Bear in mind though that the flexibility can come at a cost to the lessee. The amount that the dealership will credit you for the vehicle you provide as partial or full payment for another vehicle.

You are given a value as to the estimation of what the value of the hardware will be at the end of the lease. Monthly payments are usually lower than the grant of hired purchase the purchase lease requires large payments when maturing. A lease in which the lessee guarantees the lessor the difference between the residual value of the leased asset and the value realized from the assets sale at lease termination is an open-end lease it thus exposing the lessee to residual value risk.

With an open-end lease the lessee has more freedom to terminate the lease early or modify the terms but is liable for the cars residual value. We asked lessors at three fleet leasing and management companies to dig a little deeper into both to help you determine the lease that works. In a closed-end lease the lessor assumes the depreciation risk but the terms are more restrictive.

A companyemployer will assume management and leasing of the car to its employees not the leasing company. An open-end lease and a closed-end lease. Open-ended leases will usually allow for an annual mileage allowance greater than the average 12000 miles of a typical lease and the residual value may be set as being.

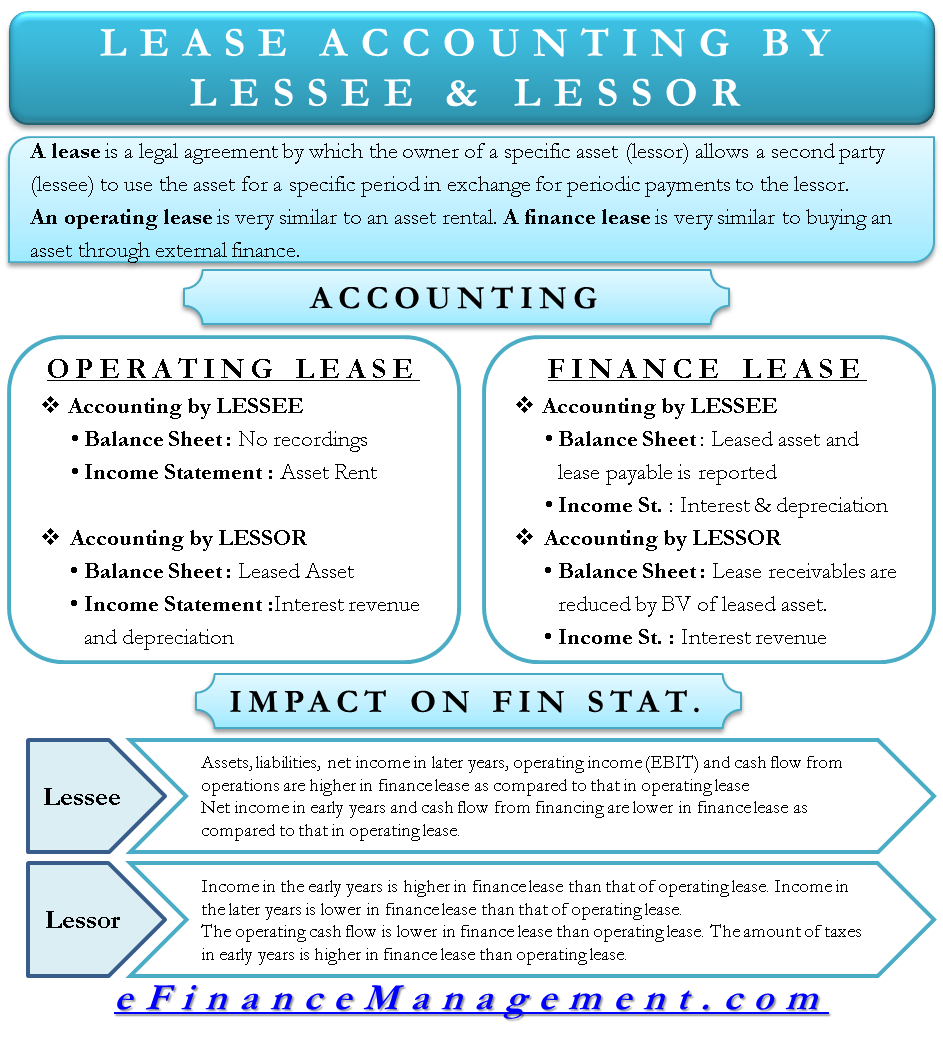

Ind As 116 Leases Detailed Analysis

Top 27 Lease Agreement Clauses To Protect Landlords

Should You Lease And Then Buy A Car Bankrate

What Is Residual Value When You Lease A Car Credit Karma

What Is A Balloon Payment On A Car Lease Credit Karma

How To Lease A Car Credit Karma

Can I End My Car Lease Early If I Become Disabled Bankrate Com

Rental Guide How A Landlord Can End A Tenancy In Ontario

Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap

:max_bytes(150000):strip_icc()/GettyImages-912785590-bd21254b8f914ad1a28876e45800554c.jpg)

:max_bytes(150000):strip_icc()/Short-Term_Car_Lease_GettyImages-1152293815-559b180c09644bb2985f5516d2a6a101.jpg)

:max_bytes(150000):strip_icc()/463652041-5bfc38f3c9e77c0026b8b3ac.jpg)

/GettyImages-1023053124-7bc6c03d72864a3486a44d768f28ccf4.jpg)

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying-v1-735d3e7993d0435c8e1dcc0831af07bc.png)

/GettyImages-392715-0061-5bb1340a46e0fb00269fd8cd.jpg)

:max_bytes(150000):strip_icc()/car-dealer-showing-new-car-to-young-couple-in-showroom-590778115-fd7e5fcf72564de69103e9f3db58d17f.jpg)

:max_bytes(150000):strip_icc()/GettyImages-960436564-1e70bdcae9fa4645af0977cd4742096b.jpg)